What Happens if I Dont Pay Portland Art Tax

Critics argue the city of Portland is using aggressive, heavy-handed tactics to recover the $35 tax.

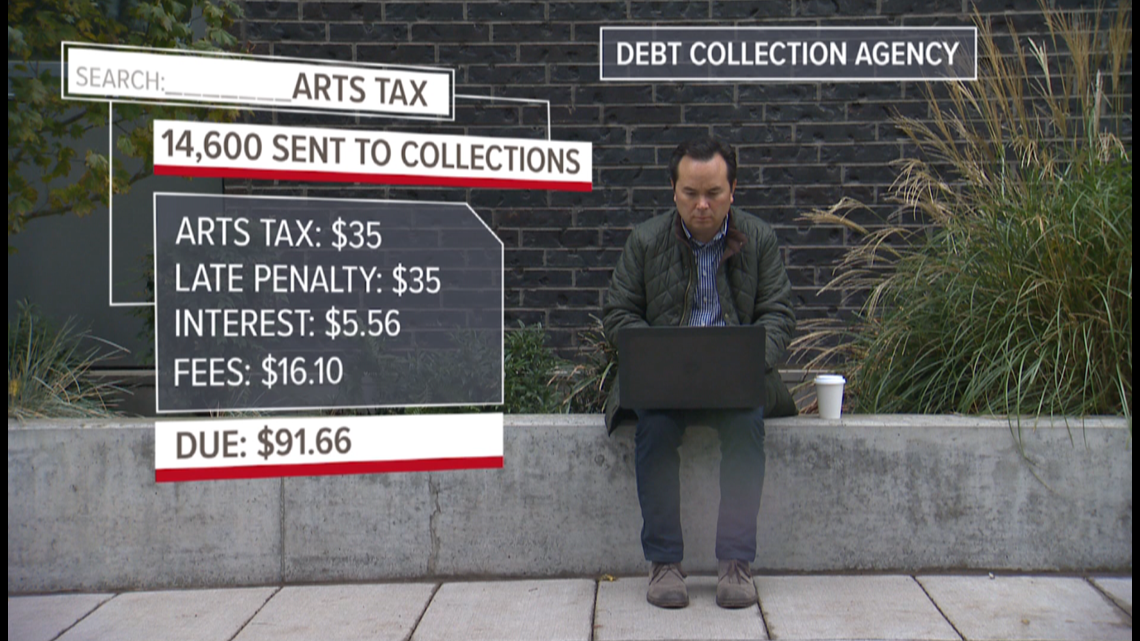

PORTLAND, Ore. — The city of Portland has been using a private debt collector to get subsequently residents who didn't pay the Arts Tax. Since 2016, the metropolis's revenue segmentation has sent fourteen,600 taxpayers to collections for declining to pay the $35 taxation.

Critics argue the tactic is besides castigating. If unpaid, the city doubles the corporeality owed on the Arts Tax from $35 to $70. A private debt collector tacks on additional collection fees and interest. Every bit a upshot, small unpaid tax bills can easily balloon into hundreds of dollars, creating stress and uncertainty.

"It can change your whole life -- getting hounded to pay a debt," said Portland attorney and consumer advocate Michael Fuller.

For example, the Arts Tax starts at $35. If you lot neglect to pay, the city adds a $35 penalty. A private debt collector tacks on $5.56 interest and $xvi.10 in collection fees. All of a sudden, payment due for the Arts Taxation has jumped from $35 to $91.66, a 162% increase.

The longer y'all wait to pay, the more debt collectors make.

"It'due south kind of a dirty secret," said Fuller.

In November 2012, 62% of Portland voters approved the Arts Tax. By police, every Portland resident age 18 and older must pay $35. The metropolis bundles the money then distributes it to help pay for more than fine art teachers and art programs effectually the city.

Since its inception, the Arts Tax has been a lightening rod of controversy triggering lawsuits and complaints.

"I recall its completely unfair," said Laurel Greenwood of Portland.

Greenwood was dislocated afterward getting three demand letters from a private collection agency in Springfield, Oregon. The notices from Professional Credit Service didn't explain why or who she owed. It was an odd corporeality: $91.66.

"My husband said this is for that Arts Tax that you are supposed to be exempt from," explained Greenwood, who idea she didn't accept to pay the Arts Tax considering she is on social security for a permanent disability. Greenwood said she sent the city paperwork months earlier, explaining she was exempt but never heard back.

"It'south very disruptive. Why are we getting these letters? We are exempt. Why are they sending u.s. to collections?" asked Greenwood. "It was just very disruptive to u.s.."

Greenwood said she also sent documentation to the collection agency in hopes of clearing upward whatsoever confusion about unpaid taxes and debt.

Residents are exempt from the Arts Tax if their household income is beneath the federal poverty level and their personal income -- not including social security -- is $1,000 or less. Critics argue this complex formula places an unreasonable burden on the poor and disabled because they must testify they are exempt.

The city of Portland claims Greenwood is not exempt and declined to explain why, citing taxpayer confidentiality. Greenwood provided the revenue segmentation a letter waiving confidentiality, allowing the city to hash out her instance with KGW.

Revenue division director Thomas Lannom wouldn't elaborate on Greenwood's example except to say in that location were some "misunderstandings" and she had to pay.

Lannom declined 3 requests for an on-camera interview regarding the Arts Tax and the urban center'south use of a private collection agency to recover delinquent payments. Lannom said the public agency would only respond this reporter'due south questions in writing.

The metropolis sends a warning letter of the alphabet to residents if they fall behind on the Arts Tax and says taxpayers are sent to collections if they owe $100 or more.

By outsourcing its dirty work and allowing a private debt collector to charge a 23% fee and ix percent interest, the metropolis gets these drove services free of charge.

"It is a common do for revenue enhancement agencies to use third political party collection agencies to pursue delinquent tax debt," wrote Tyler Wallace, Portland revenue enhancement sectionalization managing director in an e-mail. "It is effective in increasing compliance."

Debt collectors that piece of work for the regime don't have to work within the confines of consumer protection laws, like the Off-white Debt Collection Practices Act (FDCPA), opening the door for aggressive tactics and college fees.

"This kind of tax is unique," warned Fuller, the attorney and consumer advocate. "Consumers don't have any protections under the police force from calumniating tactics to collect this type of debt."

The city said Professional Credit Services, the debt collector contracted to go after unpaid Arts Tax payments, complies with FDCPA. The revenue division admits it conducts no audits or reviews to monitor the drove agency's functioning or practices.

Source: https://www.kgw.com/article/news/investigations/portland-sent-14600-people-to-a-private-debt-collector-over-unpaid-arts-tax/283-c1a47640-bdc2-4f26-a788-5c62c2511966#:~:text=If%20you%20fail%20to%20pay,%2491.66%2C%20a%20162%25%20increase.&text=The%20longer%20you%20wait%20to%20pay%2C%20the%20more%20debt%20collectors%20make.

0 Response to "What Happens if I Dont Pay Portland Art Tax"

Post a Comment